The global alcoholic drinks market – including wine – has been in a downward phase over the past decade. Peter Bailey, manager of Market Insights for Wine Australia, provided an overview of the state of the wine market at the Wine Industry Update.

Per capita consumption has been declining as people have been moderating their alcohol intake primarily due to health and wellness concerns and, more recently, in response to cost-of-living pressures as many prioritise spending on essentials over alcoholic drinks.

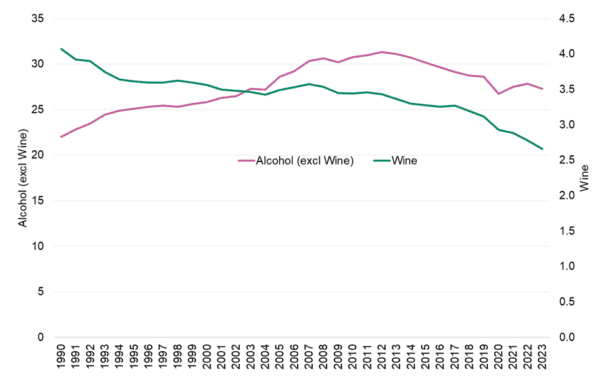

Wine consumption has declined at a much faster rate than other alcoholic drinks in recent years. Figure 1 shows the consumption of wine (the green line) versus other alcoholic drinks (the pink line). The pace of decline in wine consumption has accelerated since the advent of the Covid-19 pandemic in 2020.

Wine consumption has fallen by four percent per annum compared to other alcoholic drinks at one percent. Prior to the pandemic both were declining at one percent per annum. Per capita wine consumption is now a quarter less than it was 20 years ago while other alcoholic drinks are at the same level.

Figure 1. Global per capita consumption – still wine vs other alcoholic beverages (litres per person). Source: IWSR.

Over the consumer changes during this time, other categories, such as beer and spirits, have innovated products to remain relevant in a highly competitive market.

The wine category globally has struggled to navigate through this changing environment and wine consumption continues to fall.

Some consumers are abstaining from drinking wine, others are drinking less but paying more per bottle, while some are seeking no or low alcohol wine options.

Wine has become less of an everyday drink and more of an occasion-based drink.

As a result, in many markets the number of wine drinkers has fallen and those who do drink wine are drinking less.

Older consumers, who are the biggest wine drinkers, are moderating their consumption while younger consumers are not drinking as much as previous generations.

There are also significant changes in the on-premise channel.

Due to the pandemic and associated lockdowns, now compounded by cost-of-living pressures and increased taxes on alcohol, many on-premise establishments have closed. There are also fewer visits to venues that remain open.

Furthermore, motivations for visiting the on-premise, especially among younger consumers, are changing. Younger consumers are increasingly seeking experiences beyond food and wine, and wine ranks last in the drinks categories that they consume in the on-premise.

On the other hand, Boomers stick with more traditional occasions centred around food – and wine is their preferred beverage.

However, Boomers are less frequent visitors to the on-premise and they are also spending less. Proportionally, this is having a greater impact on wine as it is traditionally consumed during food-led occasions.

All of these factors have resulted in wine consumption falling at a greater rate than other alcoholic drinks across the globe.

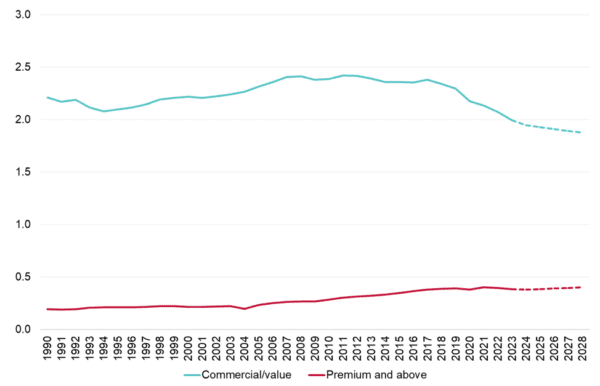

There are differences in global wine consumption trends by price segment.

Wine consumption at premium price segments (US$10 or more per bottle – the red line on Figure 2) has grown, while consumption at the commercial/value end (less than US$10 per bottle – the blue line) has been declining.

This is an indication that consumers are drinking less wine but choosing to increasingly purchase at higher price points, although this premium growth has slowed in the last couple of years due to cost of living pressures.

Figure 2. Global wine consumption by price segment (billion cases). Source: IWSR.

It is important to put the two price segments in context – commercial wines make up 84 percent of the volume and 60 percent of the value consumed globally and will remain the major segment of the market – but the segment is in steady decline.

These price segment trends disproportionally effect Australia, given commercial price segments are by far the largest share of Australian export volumes – and Australia over-indexes in this segment.

In the last year, 90 percent of the volume of Australia’s exports were at the commercial end.

While the IWSR has forecast growth in premium wine sales out to 2028, it will not offset the decline in commercial sales.

In the next five years, commercial wine sales are forecast to decline by 117 million cases, but premium wine sales are forecast to grow by 18 million cases – less than 20 percent of the decline in commercial volumes.

This indicates that the volume of wine consumption across the globe will continue to decline in the next five years, despite growth in the global population.

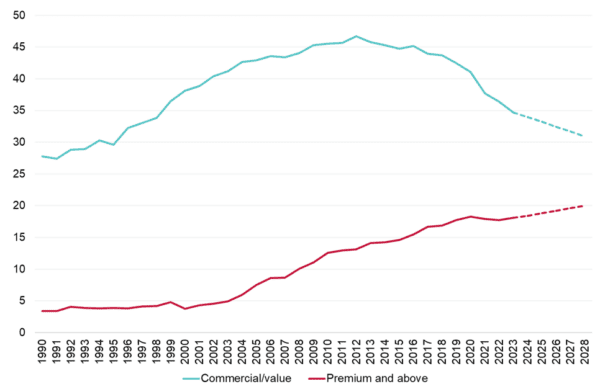

Premiumisation trend stronger in domestic market

Figure 3 shows that the trend towards premium wines is even stronger in the domestic market. The volume share of commercial/value wines in Australia has fallen from three-quarters to two-thirds in the last decade. The IWSR is forecasting this share to fall to 61 percent by 2028.

In contrast, the premium wine segment is forecast to grow but by only half the decline in the commercial/value segment.

As a result, the total wine market is forecast to shrink by almost two million cases by 2028.

This suggests that for total Australian wine sales to grow into the future, we must look to export markets.

Figure 3. Wine consumption in Australia by price segment (million cases). Source: IWSR.

Currently, around 60 percent of the wine that Australia produces is exported. Therefore, global market trends significantly impact Australian wine producers and grapegrowers, both in terms of how much supply is required to support demand as well as the appropriate mix of varieties, wine styles and price points.

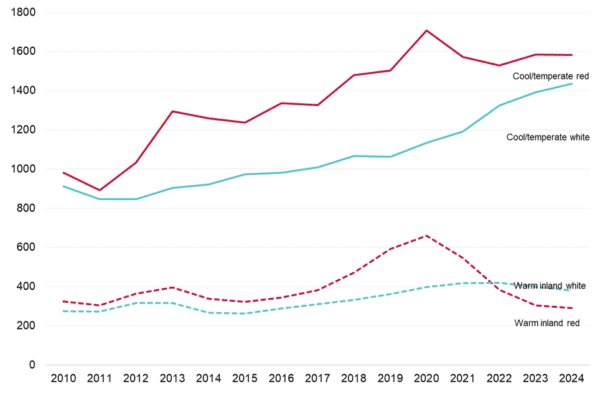

In the six years to 2020, Australia’s supply and demand of both red and white wine was relatively in balance with stocks-to-sales ratios at manageable levels.

However, a record crush in 2021 combined with falling global demand for wine saw Australian wine supply and demand balances, especially for red wine, move into a significant oversupply position.

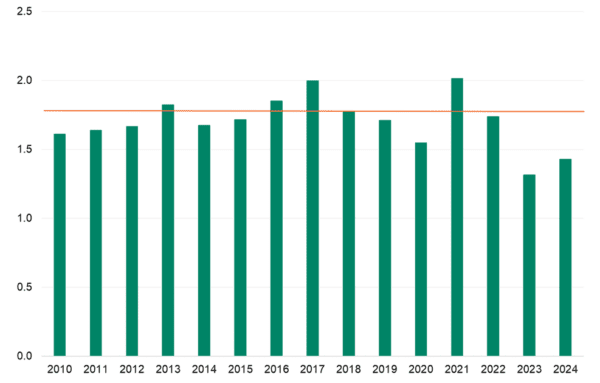

In response, the size of the national winegrape crush has been reduced in the past three vintages, and most significantly in 2023 and 2024 (see Figure 4).

While the Australian crush increased by nine percent in 2024 to an estimated 1.43 million tonnes, it follows a 23-year low crush in 2023. Despite the increase in tonnes, this year’s crush is 300,000 tonnes below the 10-year average of 1.73 million tonnes.

As discussed, the size of the wine market globally is shrinking and Australia, as a key producer, is not immune to this. The reality is that the world has been producing more wine than is required and supply needs to adjust.

Figure 4. Australian winegrape crush over time (million tonnes). Source: Wine Australia.

While the crush of both red and white grapes has fallen over the past three vintages, the red crush has fallen more significantly, reflecting the oversupply situation for reds (see Figure 5).

The small increase in the national crush in 2024 was driven overall by white varieties, which increased by 19 percent.

Despite the increase, the white crush was still 10 percent below the 10-year average and the second smallest in 17 years.

This suggests that while whites in general are in a more balanced position than reds, there is not booming demand for white wine globally that would drive a significant increase in national production or encourage growers to switch plantings from reds to whites.

The crush of red grapes declined by one percent, resulting in the smallest red crush since the drought-affected 2007 vintage.

The overall reduction in the red crush was entirely driven by Shiraz, which decreased by 48,000 tonnes. While the crush of most other red varieties increased, the tonnages were still very low from a historical perspective.

And so, for the first time since 2014, the white grape crush overtook the red crush.

Figure 5. Australian winegrape crush – red v white (million tonnes). Source: Wine Australia.

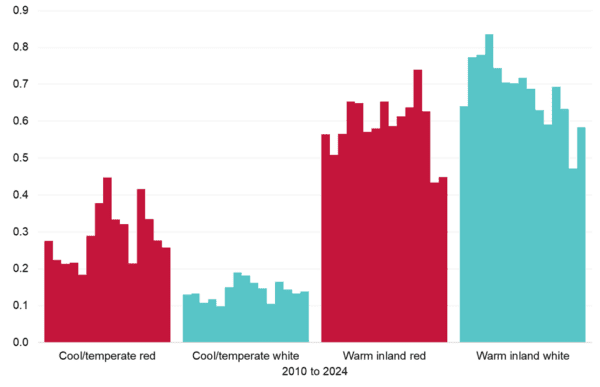

While all regions are impacted by the changing market conditions, some are impacted more than others.

The warm inland regions of the Riverland, Riverina and Murray Darling-Swan Hill produced more than 70 percent of the crush in 2024 and are the main suppliers of Australia’s wines at commercial price points.

This is the biggest segment globally by volume but the one in long-term decline.

The remaining 30 percent of Australia’s crush came from the other 60 plus regions which for the purposes of this presentation have been combined as cool and temperate.

Most of their supply goes into wines at premium price points – a smaller segment globally by volume but one that is growing, albeit at a slower rate than previously.

This is not suggesting that some warm inland grapes do not go into premium wines or conversely that some cool and temperate grapes are not sourced for the commercial price segment.

Figure 6 illustrates that the red crush has been reduced in both the warm inland and cool and temperate regions in the past three vintages, the exception being a very small uplift in 2024 in the warm inland regions.

In comparison, the white cush has fallen by far fewer tonnes than for reds.

Figure 6. Australian winegrape crush by source and colour (million tonnes). Source: Wine Australia.

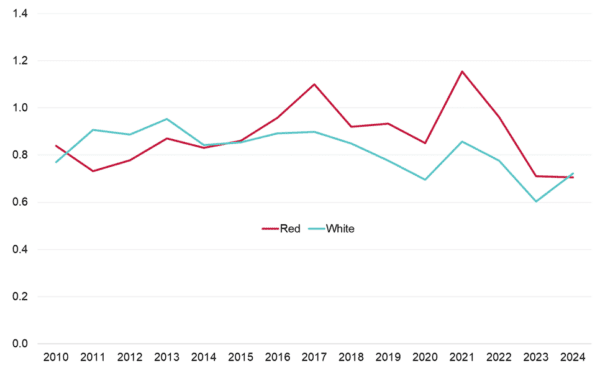

While the tonnes crushed have been reduced for both red and white winegrapes, the impact on grape purchase prices is very much dependent on both the region of origin and the grape colour.

Figure 7 highlights that while the red grape average purchase price has fallen by seven percent in the cool and temperate regions since 2020, the drop in the warm inland regions has been far more dramatic, falling by 55 percent.

On the other hand, the average price paid for cool and temperate whites continues a long-term upward trend, reflecting stronger demand for premium whites.

In contrast, after a period of growth, the prices paid for warm inland whites have eased down five percent compared to 2020, reflecting that the demand is not as strong at the commercial end of the market for whites.

To finish the discussion on supply, the reduction in the crush doesn’t necessarily reflect a decrease in the underlying supply base. There is no indication that the vineyard area has declined significantly nationally.

For example, in South Australia in the past three years, the total vineyard area has declined by less than two percent while the total crush in the state has fallen by 33 percent.

This highlights that the reduced crush in the state is the result of active yield management and, to a lesser extent, seasonal conditions, rather than reduced vineyard area.

This suggests that the potential for a large national crush still exists.

Figure 7. Average winegrape purchase prices by source and colour ($ per tonne). Source: Wine Australia.

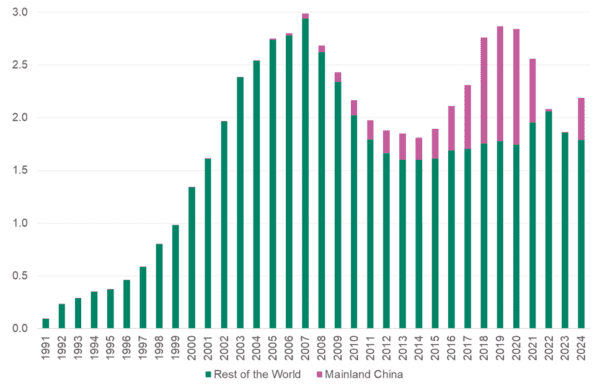

Premium wine re-entering mainland China drives overall export value increase

Global market trends and trading conditions are impacting Australia’s wine exports.

In 2023-24, Australian wine was exported to 115 destinations. Exports increased in value by 17 percent to $2.2 billion, the highest level since the 12 months ended September 2021. Volume was relatively stable at close to 620 million litres.

The growth in value was due to a surge in exports to mainland China which came in the last three months of the financial year, following the removal of the duties on Australian bottled wine in late March 2024.

Exports to mainland China grew by $392 million to reach $400 million for the year (see the pink bar on Figure 8). Volume grew by 32 million litres to 33 million litres. Wines priced at $20 or more a litre were the main driver of the value growth while the volume growth came in the same price segment as well as in bulk exports below $1 per litre.

Exports to the rest of the world (excluding mainland China) declined by around five percent, with the volume falling to the lowest level since 2003-04.

Exports have also been impacted by enduring problems in shipping, with a shortage of ships globally and freight and charter rates on the rise.

Australia is not the only country negatively impacted by the tough trading conditions. Globally, wine exports have also declined from Spain, France, Chile, South Africa, Germany and New Zealand.

Figure 8. Value of Australian exports over time – mainland China and Rest of the World (A$ billion). Source: Wine Australia.

While the export figures to mainland China are very positive, they represent the restocking of Australian wine in the pipeline of a major market after a long absence.

They do not necessarily equate to retail sales and it will take some time before there is a clearer picture of how Chinese consumers are responding to the increased availability of Australian wine in-market.

The current level of Australian exports to China is still a small fraction of the historical peaks achieved to the market and it is very unlikely that Australian wine exports will return to those previous peaks in the short to medium term.

The reason is that the wine market in China is very different now compared to when the duties were imposed in late 2020.

Consumption of both domestic and imported wines in China is less than a third of what it was six years ago.

Also, the current volume of Australian exports to China is relatively small from a supply perspective – it equates to around 47,000 tonnes which is less than five percent of the 2024 national crush.

This volume is unlikely to make a significant impact on Australia’s current oversupply of red grapes, particularly in the big volume-producing warm inland regions.

A global pool of 160 million people drink wine but not Australian wine

As global wine consumption is declining, driven predominantly by moderation trends, the growth opportunity for Australian wine is to recruit new consumers to the Australian wine category, rather than encourage existing Australian wine drinkers to drink more.

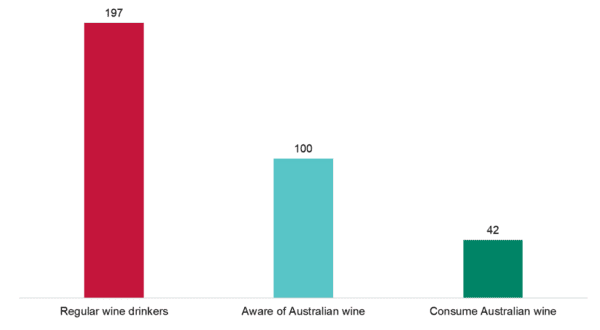

And importantly, there is a large cohort of people who have yet to discover Australian wine (see Figure 9).

Research from Wine Intelligence on seven key wine export markets (USA, Canada, United Kingdom, Japan, South Korea, India and Vietnam) showed there are almost 200 million regular wine drinkers across those markets.

Of these, 100 million are aware of Australian wine but only 42 million drink Australian wine.

This suggests that there is an untapped pool of almost 160 million people that currently drink wine but do not currently drink Australian wine.

Extrapolate this across more markets, and the pool grows significantly.

Figure 9. Number of wine drinkers (million people). Source: Wine Intelligence.

Commercial wine opportunities in emerging markets

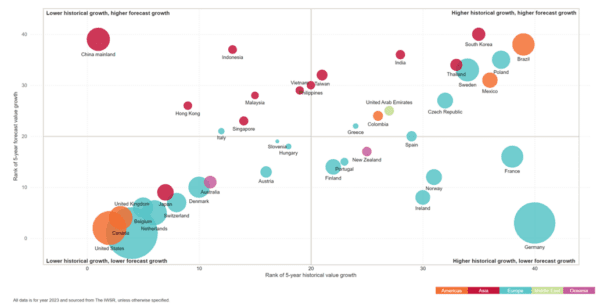

Visuals from Wine Australia’s Market Explorer illustrate where the opportunities by market might be for the two broad price segments discussed earlier – commercial/value and the premium and above price segments.

This is a quantitative analysis, and it is incumbent on individual companies to do further in-depth research to determine if these markets are suitable for their portfolios.

Figure 10 shows the relative opportunity by market for commercial/value wines.

The size of the bubble reflects the size of the market, while the x-axis shows the historical value growth, and the y-axis shows the forecast value growth.

The best opportunities are in the top right-hand corner of the chart – where there is both strong historical and forecast growth.

For the commercial segment, most of the decline is coming in the bigger, more established markets such as Australia, UK, US and Canada.

The growth is coming from smaller European markets and more emerging markets in Asia and the Americas.

Australia generally has a relatively large share of the imported commercial wine segment in the established markets which are in decline.

For example, Australia holds a 24 percent share of the imported commercial wine segment in the UK and a 20 percent share in the US.

While these markets are substantial in size and will remain so, they are declining markets for commercial wine and hence the opportunity lies in taking market share off competitors which is a tougher proposition in a declining market.

Margins are also very tight at this end of the market, and oversupply will add further pressure. To compete at this end of the market also requires scale and relatively low production costs. For these established markets, it is very much a defend position for Australia.

Figure 10. Size and growth of imported commercial wine markets. Source: Wine Australia and IWSR.

Premium wine opportunities

Figure 11 shows the opportunities by market for the premium and above segment.

The opportunities for premium wine sales are greater in terms of both the overall value growth and the number and diversity of the markets that are in growth.

The biggest opportunities are in the more established markets where commercial sales are declining but premium sales are growing such as the US, Canada, Australia and, to a lesser extent, the UK, China, Japan and South Korea.

There are also opportunities in emerging markets in Asia and the Americas and in smaller markets in Europe.

In many of these markets, Australia’s share of premium wine sales is well below its share of the commercial segment. For example, in the UK, Australia holds an 11 percent share and in the US a nine percent share of the imported premium wine market.

On the other hand, Australia’s position in China was previously heavily focused on premium wine sales, with Australia holding a 34 percent share of the premium wine market in 2020. Hence there is significant upside in these key markets for Australian wine

While there is opportunity in most premium price points, $15 to $30 is the sweet spot in most markets for Australia.

Figure 11. Size and growth of imported premium wine markets. Source: Wine Australia and IWSR.

Related content

Recent Comments