There will be sustained downward pressure on red grape pricing across Australia’s key production regions of the Riverina, Riverland and Murray Darling-Swan Hill, according to new economic modelling from ABARES.

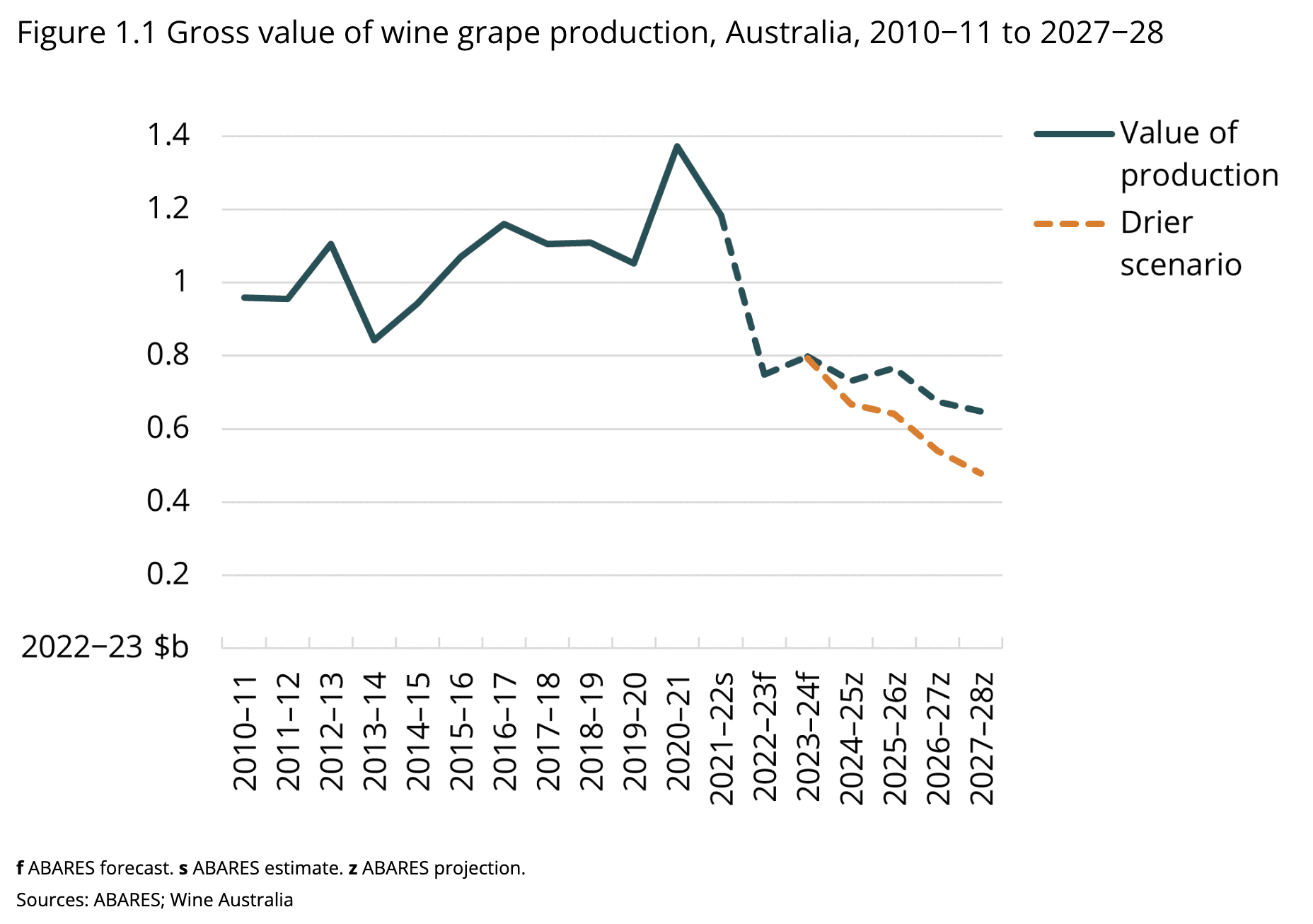

The report shows that the value of winegrape production in 2022-23 was down 32 percent to $749 million.

It says red winegrape prices are expected to remain low over the outlook period.

“These low prices, combined with wet conditions and disease pressures, have incentivised crop abandonment and subsequently lowered production volumes,” the report says.

“Wine exports are expected to fall in line with low prices and production.”

The report says that over the outlook period to 2027−28, the value of winegrape production is expected to fall to $647 million in real terms.

“Consistently low prices for red grapes and a globally oversupplied red wine market are expected to incentivise a reduction by growers in red winegrape bearing area,” it says.

“Yields are also expected to diminish over the outlook period in line with reduced rainfall compared to the last three years.

“In the drier scenario, it is expected that the value of winegrape production will fall rapidly to $478 million in real terms by 2027-28.

“Higher water allocation prices, a slower global recovery in demand and significant area reductions due to low prices are expected to reduce growers’ capacity to produce.”

Lee McLean, chief executive of Australian Grape & Wine, says the report will help businesses to make more informed decisions in the years ahead.

“While also highlighting the need to increase investment in diversifying our export markets,” he says.

Australian Grape & Wine’s Pre-Budget Submission presents a range of options for the Australian Government to consider to help drive demand at home and abroad, to innovate in the vineyard and winery, and improve sustainability in the vineyard at a very challenging time for many growers and winemakers.

“The effective closure of the $1.2 billion China market was an economic shock to our sector and has contributed directly to the picture painted by ABARES in its report,” says Mr McLean.

“As we note in our Pre-Budget Submission, the challenge for industry and government now is to work together to overcome the immediate hurdles while ensuring we invest in a more sustainable future.”

ABARES’ quarterly winegrape market report has been made possible by the Australian Government’s Improving Market Transparency in Perishable Agricultural Good Industries grants program, which enabled Australian Grape & Wine, the Inland Wine Regions Alliance and Wine Australia to collaborate with ABARES to help improve winegrape pricing information.

“This ABARES report is one of several responses to the recommendations that came from the ACCC Winegrape Market Study targeted to assisting growers understand how the market is performing so they can make informed decisions during the season,” says Mr McLean.

“This independent reporting will help level the playing field for market information along the supply chain.”

Australian Grape & Wine, in collaboration with the Inland Wine Regions Alliance and regional grape and wine associations, will use the forecast data to provide respective members with regular market insights and a greater perspective on grape pricing.

It will complement other information available to our sector, including Wine Australia’s National Vintage Survey, which will be released in early July.

Related content

Recent Comments